It's that time of year again: As 2021 just ended, we recommend that you start collecting or verifying Social Security or EIN numbers and addresses of individuals to whom you are required to issue a Form 1099.

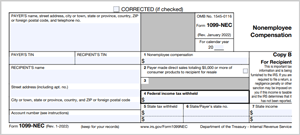

The forms must be prepared and sent to recipients on or before January 31, 2022. There are several types of 1099s; for most businesses, the most common form used for nonemployee compensation is Form 1099-NEC.

You are responsible for issuing a Form 1099 if you: